Nigeria's compulsory public building insurance law explained

The Federal Government has issued a new directive making insurance mandatory for all public buildings and certain facilities in Nigeria. This move aims to protect lives, property, and businesses from unforeseen disasters, such as fire, flooding, and building collapse.

Who Must Get Insurance

If you own or manage any of the following, you are now required by law to have insurance coverage:

Tenement houses

Rented apartments and hostels

Shopping malls, office complexes, and business premises

Schools and hospitals

Petroleum and gas stations, installations, and vehicles

Federal Government assets and employees

What the Insurance Covers

The policy ensures financial protection against major hazards, including:

Fire outbreaks

Building collapse

Flooding and storm damage

Earthquakes and other natural disasters

Legal liabilities arising from accidents or damages to the property

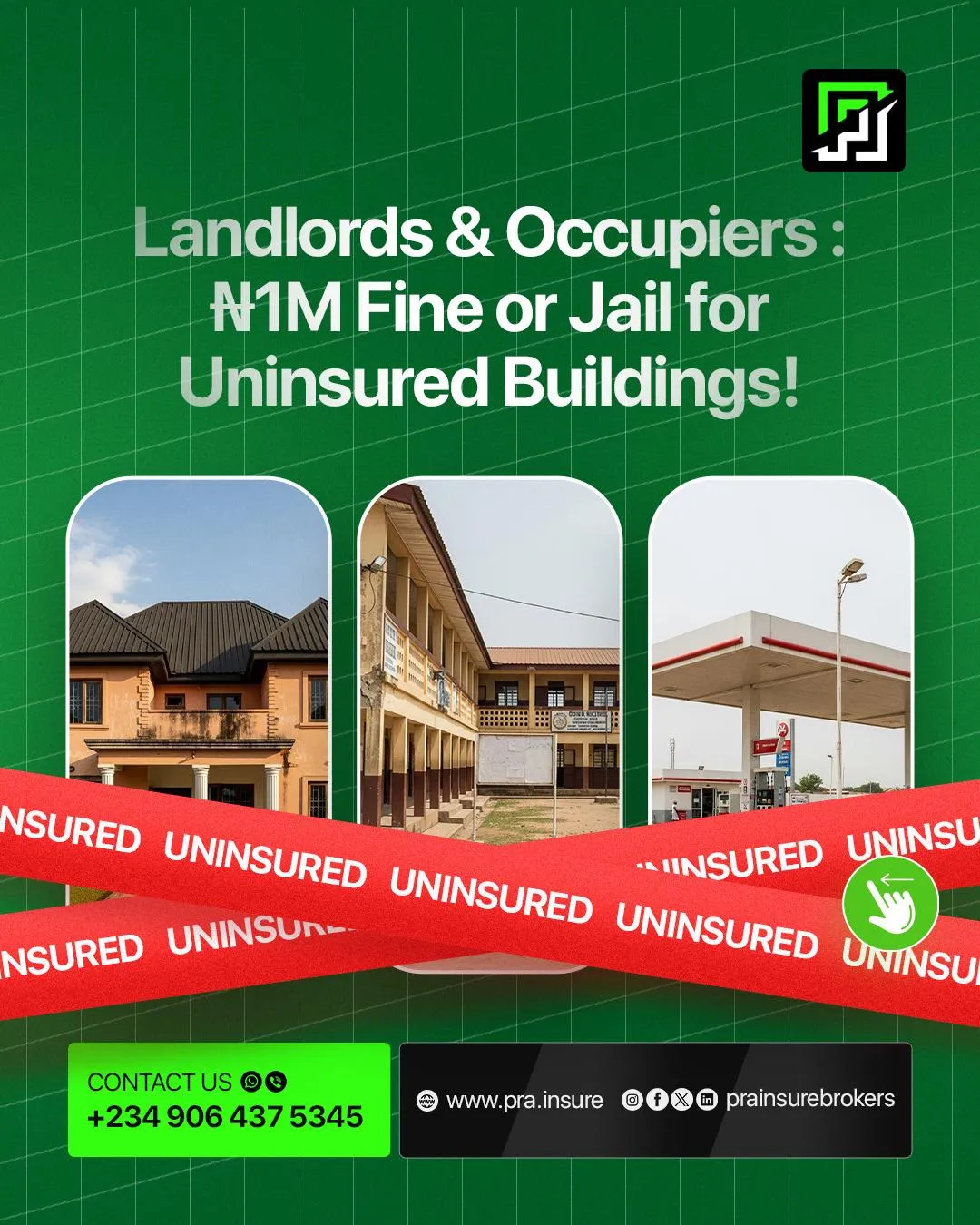

Penalties for Non-Compliance

Failure to comply with this law attracts strict penalties:

For public buildings: ₦1 million fine or up to 12 months imprisonment.

For petroleum businesses: ₦1 million fine or up to 2 years imprisonment.

Repeat offenders may face higher fines or have their licenses canceled.

Additionally, insurance providers must remit 0.25% of net premiums quarterly to a Fire Services Maintenance Fund to improve fire response services nationwide.

What This Means for Tenants and the Public

This law does not add an extra financial burden to tenants. The insurance cost is typically covered under the service charge, not a new rent increase. The aim is to ensure better safety and quicker compensation in the event of an accident.

Why This Reform Matters

Nigeria has witnessed repeated tragedies from fires, collapses, and other disasters, often leaving victims without support. This reform ensures that:

Properties are adequately protected.

Victims and their families receive compensation.

Public safety standards are enforced across all sectors.

Final Thoughts

This policy is a step toward building a safer and more financially secure Nigeria. If you own or manage a property covered by this law, now is the time to comply and secure the right insurance coverage to avoid penalties and protect lives.